Argentina’s BBVA Frances seeking stable relationship with Wall St.

The CEO of BBVA Frances celebrated the 25th anniversary of the Argentine bank’s listing on the New York Stock Exchange with a call for maintaining regular contacts with international investors.

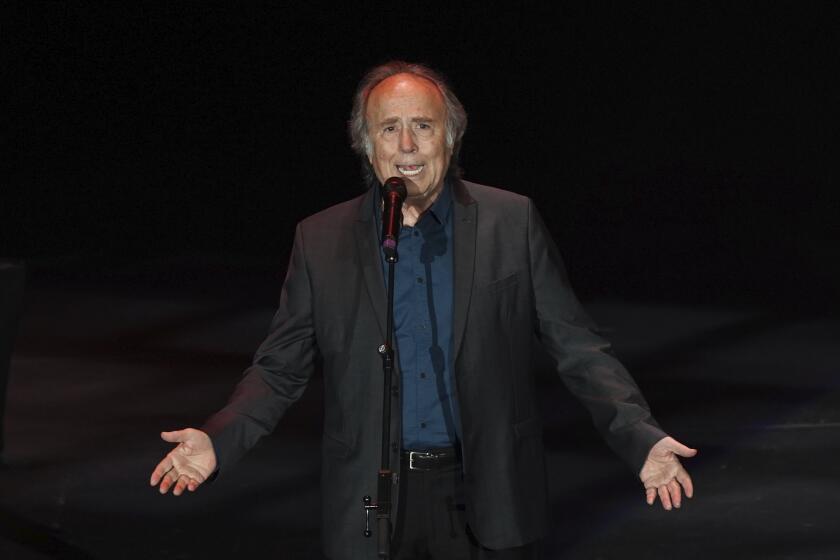

In an interview with EFE on his visit to New York to speak with analysts and investors, Martin Zarich said that his effort to transform the bank is going “full speed ahead.”

As an example of that, he predicted that within 18 months BBVA Frances will be undertaking activities and developing applications in the Cloud, moving its computer centers to facilitate customers’ access in whatever country they may be located.

To celebrate the 25th anniversary of the bank’s NYSE listing, Zarich and his management team on Tuesday presided at the traditional Opening Bell ceremony kicking off the trading session on the New York exchange.

Zarich said that BBVA Frances engages in “regulatory supervision that is unique in the world.”

In addition to Argentina’s regulatory oversight, the bank also adheres to the financial controls imposed by the NYSE as well as by European regulators since over 60 percent of the assets of BBVA, Spain’s second-largest financial institution, are in Europe.

“We have unique control (mechanisms) and that is very good because the American market is absolutely transparent and it forces us to have a discipline that we consider very positive, and that always gives confidence to investors,” Zarich said.

The CEO says that he wants “dynamic regulation of contacts” with investors because, regardless of the situation, “you have to come here and show your face.”

Zarich, who has spent his entire career with BBVA Frances, had had to deal with all sorts of situations in his home country and that gives him a unique perspective when it comes to analyzing how Argentina faces the current situation and, above all, the future - which is of concern to US analysts.

“I have a reasonably positive medium-term view of Argentina,” Zarich said, primarily because he sees the current government as being firm in charting its course without the sharp shifts of the past and he hailed the fact that there is a balanced budget forecast for 2019 and an anticipated surplus for 2020.

In this context, BBVA Frances, which is in the forefront of private Argentine banks due to its profitability, comes to New York showing good results over the first nine months of this year, when its net profit rose 117 percent.

BBVA Frances has increased its customer base by 25 percent over the past two years and reduced the number of cash transactions by 20 percent, along with eliminating paper in its interactions with customers, “a series of transformations that allow us to improve our efficiency ratio, quite apart from providing better service to the customers.”